News

Site Editor

Site

/uploads/image/64e425c3edfef.png

As the end of the year approaches, the demand and transactions in the storage market are gradually slowing down, but the market atmosphere remains lively between channel merchants and end customers.

Site

/uploads/image/64e425c3edfef.png

As the end of the year approaches, the demand and transactions in the storage market are gradually slowing down, but the market atmosphere remains lively between channel merchants and end customers.

Industry Quick Report: Chip Prices Continuously Rise

Views: 1251

Author: Site Editor

Publish Time: 2024-02-02

Origin: Site

As the end of the year approaches, the demand and transactions in the storage market are gradually slowing down, but the market atmosphere remains lively between channel merchants and end customers. Chip prices have been continuously rising since August last year. Faced with the clear price control strategy of the original factory, the industry generally holds an optimistic attitude towards the market after the Spring Festival, so channel merchants and end customers are actively stocking up.

In the upstream of the industry chain, although the original factory has confirmed that it will increase production of certain types of DRAM, with a focus on meeting the high demand for high-end memory products such as HBM and DDR5. However, for other types of memory such as DDR4, in order to improve profitability, the original factory continues to push for price increases.

The price of NAND Flash has started to rise quarter by quarter due to the previous significant decline, and the original factory has frequently raised prices. The market expects prices to continue to rise until the end of 2024, with a cumulative increase of up to 60%. This reflects the industry's optimistic view on the future prospects of the storage market.

It is worth mentioning that SK Hynix's financial report for the fourth quarter of 2023 showed that the company's operating profit reached 346 billion Korean won, ending its continuous loss state since the fourth quarter of 2022 and successfully turning losses into profits, marking the beginning of a positive development in the storage market.

This week's memory spot market situation shows that memory prices are still showing a slight upward trend. As the Spring Festival approaches, demand and trading activities begin to slow down, and many factories have also entered the year-end stage. People have high expectations for the post holiday market. The price of Flash Wafer continues to rise, with a contract price of approximately 6.4/3.3 USD for 128GB/64GB TLC NAND Flash. The spot price is slightly higher, mainly due to active stocking by traders in a situation of weak demand, resulting in severe price inversion between components and finished products. The overall spot price of

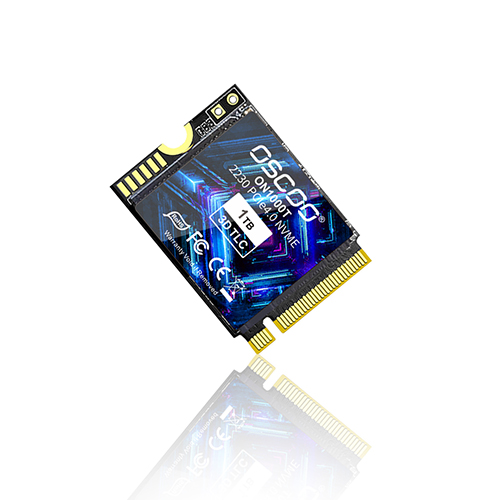

SSD remains stable, and as the year-end atmosphere intensifies, trading becomes even rarer, but the upstream trend remains unchanged.

The SSD market, DRAM market, and FLASH Wafer market have all shown a trend of stable but rising prices, while the USB market, including USB 2.0/3.0 and TF cards, has also shown a slight increase in prices. This is mainly driven by the active stocking of factories and traders, as well as the clear attitude of the original factory towards price increases, despite the imbalance between component costs and finished product prices.